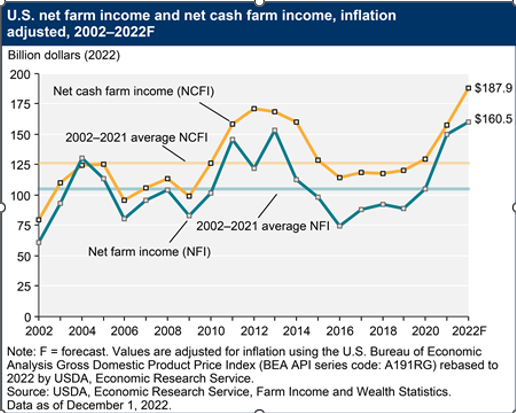

“High commodity prices will propel the United States’ net farm income to a record $160.5 billion this year, despite a steep climb in expenses.”

The United States Department of Agriculture (USDA) has predicted farm income to be 14 percent higher than last year. That’s twice as high as three years ago.

Value of farm assets would climb 10 percent this year, following a 10 percent increase in 2021, second highest year.

Farm debt will climb more slowly, USDA said. The debt-to-asset ratio will drop to 13.05 percent, its first decline since 2011.

Crops and livestock will generate $541.5 billion in cash receipts, up 24 percent or nearly $106 billion, from last year. Almost all of the increase, $96.8 billion, would be the result of higher prices, calculated USDA economists.

Corn, wheat, and soybean will make an additional $37 billion this year compared to last.

Higher broiler chicken prices would boost receipts by 55 percent. Revenue from cattle, hogs, turkeys, and milk also would climb. “Cash receipts for chicken eggs are expected to more than double,” USDA said.

Commodity prices boomed with the return of China to the U.S. market in fall 2020, USDA said. They surged again after the Russian invasion of Ukraine last February.

The invasion disrupted grain and fertilizer exports from the Black Sea region. Ukraine and Russia are major wheat exporters, and Russia leads in fertilizer exports.

Farm production expenses are forecast to rise 18 percent, to a record $442 billion this year. “This would represent the largest year-to-year dollar increase in nominal terms on record,” USDA said.

Nearly every category of expense has increased, USDA said. Fertilizer, lime, and soil conditioners have increase by 47 percent.

Fuel and oil by nearly 48 percent, interest costs by 41 percent, and livestock feed, the largest category, by 17 percent.

Farm groups have focused on the rise in expenses, USDA said. With a new farm bill to be written in 2023, lawmakers are being informed of the increased costs, a factor in calculating crop subsidies.

Farm lobbyists also are requesting more protection through the government-subsidized crop insurance program.

Overall, farm cash receipts are forecast to increase by $105.7 billion, 24.3 percent, to $541.5 billion in 2022.

Total crop receipts are forecast to increase by $45.5 billion, 19 percent, from 2021 levels to $285.5 billion.

Corn receipts for corn are forecast to increase by $19.6 billion, 27.6 percent, soybeans by $14.5 billion, 29.5 percent, and wheat by $2.8 billion, 23.7 percent.

Total animal and animal product receipts are expected to increase by $60.2 billion, 30.8 percent, to $256.0 billion.

Direct government farm payments are forecast at $16.5 billion in 2022, a $9.4 billion, 36.3 percent, decrease from 2021.

Direct government farm payments include federal farm program payments paid directly to farmers and ranchers. They exclude USDA loans and insurance indemnity payments made by the Federal Crop Insurance Corporation.

“Much of this decline is due to lower supplemental and disaster assistance to farmers related to the coronavirus pandemic,” USDA said.

Total production expenses, including those associated with operator dwellings, are forecast to increase by $69.9 billion, 18.8 percent, in 2022 to $442.0 billion.

Nearly all categories of expenses are forecast to be higher in 2022. Feed, fertilizer, lime, and soil conditioner purchases are expected to see the largest dollar increases.

Farm sector equity is expected to increase by 10.6 percent in 2022 to $3.34 trillion, USAD said.

Assets on farms are forecast to increase 10.0 percent in 2022 to $3.85 trillion following increases in farm real estate values.

Farm debt is forecast to increase 5.9 percent in 2022 to $501.9 billion in nominal terms. “But it falls by 0.4 percent when adjusted for inflation,” USDA calculated.

Debt-to-asset levels are forecast to improve from 13.56 percent in 2021 to 13.05 percent in 2022.

Working capital is forecast to rise 4.7 percent relative to 2021 in nominal dollars but fall by 1.4 percent when adjusted for inflation.